NYS Inflation Checks to be issued

Inflation refund checks for NY residents

The 2025–2026 New York State budget provides for the state’s first-ever inflation refund checks. These one-time payments provide relief to New Yorkers who have paid increased sales taxes due to inflation. If you qualify for a payment, you do not need to do anything; NYS will automatically send you a check. Checks will be mailed over a period of several weeks beginning in the fall of 2025.

Are you eligible?

You are eligible for a refund check if, for tax year 2023, you:

- filed Form IT-201, New York State Resident Income Tax Return;

- reported income within the qualifying thresholds below; and

- were not claimed as a dependent on another taxpayer’s return.

How much of a refund will I receive?

The amount of your refund check depends on your income and filing status for the 2023 tax year:

| Filing status | 2023 New York Adjusted Gross Income (Form IT-201 line 33) | Refund amount |

|---|---|---|

| Single | $75,000 or less | $200 |

| more than $75,000, but not more than $150,000 | $150 | |

| Married filing joint | $150,000 or less | $400 |

| more than $150,000, but not more than $300,000 | $300 | |

| Married filing separate | $75,000 or less | $200 |

| more than $75,000, but not more than $150,000 | $150 | |

| Head of household | $75,000 or less | $200 |

| more than $75,000, but not more than $150,000 | $150 | |

| Qualified surviving spouse | $150,000 or less | $400 |

| more than $150,000, but not more than $300,000 | $300 |

When will you get your check?

NYS will begin mailing refund checks to eligible taxpayers in the fall of 2025. Your check may arrive earlier or later than your neighbors, as mailings are not based on zip code or region. There is no specific delivery schedule.

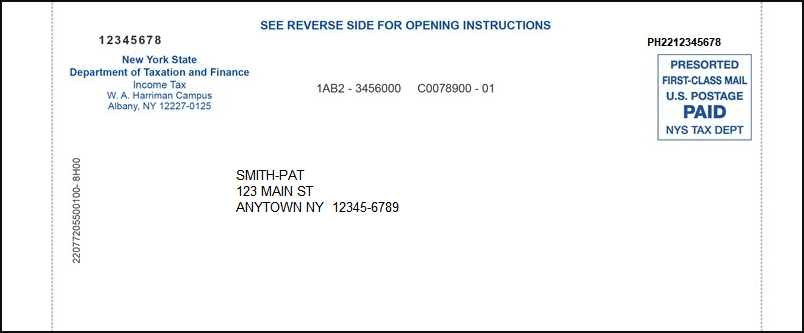

Watch your mailbox for a check that looks like this: